That’s all it takes: three things!

- Leadership

- Courage

- Decisiveness

I’m not surprised to read, yet again, that Canberra and the other states recommend ‘no change’ to the broken system. Why would we expect leadership from those who are benefiting from this broken system? The leadership, courage and decisiveness that we so badly need must come from Western Australia and this is how it could be done.

I’m not surprised to read, yet again, that Canberra and the other states recommend ‘no change’ to the broken system. Why would we expect leadership from those who are benefiting from this broken system? The leadership, courage and decisiveness that we so badly need must come from Western Australia and this is how it could be done.

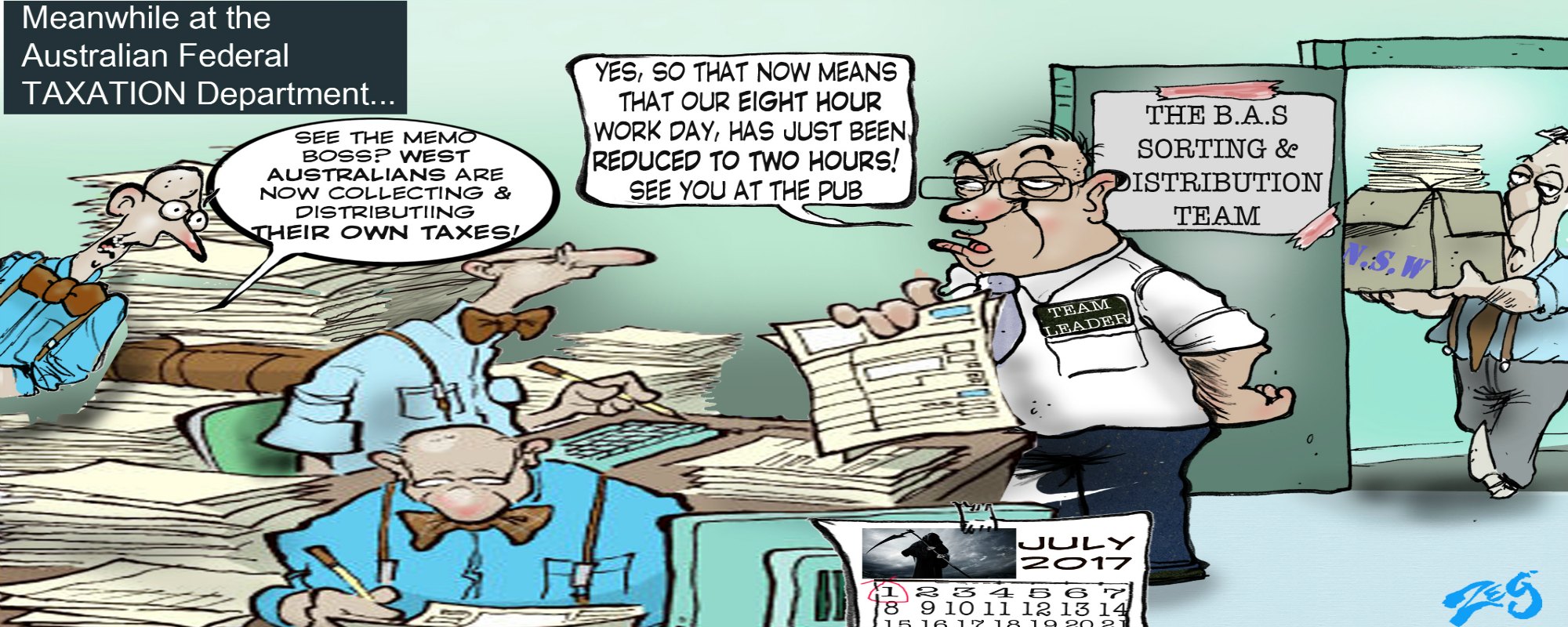

Business organizations (for example, the WA Chamber of Commerce and Industry, the Chamber of Minerals and Energy, the Association of Mining and Exploration Companies, together with head organizations from various professions) could suggest that their members (WA businesses and organizations) continue collecting and remitting GST (via BAS returns). From a certain date (say, July 1, 2017), they could remit the collected GST not to Canberra but directly to the WA State Government.

Such business entities would continue complying with their role as unpaid tax collectors, but keep the GST in WA. This would simply cut out the middleman—in this case the Federal Government. By bending the laws in this manner the efficiency of the GST would improve dramatically. This is because WA would no longer have to pay the extortionately high cost of ‘paying the freight’ on sending the money ‘east’ and receiving back only about 30 per cent of the monies ‘exported’.

With leadership, courage and decisiveness this could happen.

Constitution rules

If more of us take the time to read the Australian Constitution and the Western Australian Constitution, we would be reminded that the Federal Government was appointed by the states as agent/servant of the states, tasked with specific functions. Similarly, State Governments are servants of ‘the people’. Novel but true and I wonder why we are not encouraged to read both Constitutions.

Without leadership, courage and decisiveness nothing much will change and WA will meander on as a highly productive but remote and overlooked outpost.

The outcome is entirely in our own hands.

Note: This simple solution could quickly resolve a more threatening Constitutional challenge to the current GST distribution sham. A modern reading of Constitutional law could find that overt ‘theft’ from one state and the distribution of the proceeds to another is unconstitutional.

7 Comments

Fantastic Ron!

I can refer you to a Professor in constitutional law. He is speaking along similar lines to you.

You may already be in touch with him: Augusto Zimmerman

I agree with you.

Augusto is already an inspiration to us.

Regards

Ron

Your three thing are good and always important however cancelling all state and federal taxes levied on Western Australians and instituting a transactions tax of just 0.25% on all bank debits would generate so much revenue for the government AND save taxpayers a fortune in tax as well. The banks would collect the transaction tax and remit it to government coffers. Most wages and business income are paid into bank accounts and as more Australians move to digital money, tax avoidance becomes a moot issue.

You have a great mind Ron, a little devious maybe, and it needs to be backed by the people that can make your thoughts into actions that can then make a difference. We’re really the ‘tothersiders’ when it comes to Government thinking and getting a fair deal, that’s for sure.

Keep up the good work my friend.

I agree with you on the three things and I would add honesty ,for without honesty we would not be any better off.

Isn’t it time to start a serious conversation about secession? That seems to be a topic which gets the attention of the Feds.

I am with you in spirit on this, but the fact is that the GST is imposed and administered under Commonwealth law and therefore has to be remitted to the Commonwealth. As far as I know there is constitutional backing for that. What you are suggesting would be like employers sending their PAYG income tax instalment deductions to the WA revenue office.

As an alternative ‘radical’ idea, how about this: distribute the GST on an equal per capita basis (which would already deliver a degree of horizontal equalisation, but less than now) and then make any further horizontal equalisation — as recommended by the Grants Commission — possible only in the form of discretionary, explicit state-to-state payments under legislation by each state parliament. Thus, WA would make equalisation payments to SA, TAS, etc on the recommendation of the Grants Commission but only to the extent it decides to.