Avoiding socialism and wokeness!

During a recent office clean-up, I came across my old slide-rule …..

What a useful item this was, in its day. It made possible all manner of calculations for electrical, engineering and business calculations. To me, it was a magical device as it was a great advance over my grandfather’s much larger ‘cylindrical’ equivalent of my slide-rule.

Slide-rules were very valuable in their day but now they are simply a relic.

This reminded me of an earlier discussion I had with Brian Summers of Foundation for Economic Education (fee.org).

He used such items as examples to compare value.

In the case of my slide-rule, I placed a much higher value on it, compared with the cost of manufacture, simply because it significantly increased my productivity. That was my reason for valuing it much higher than its cost.

Since then, its value as a relic is close to zero which again bears no relationship to the cost of its production.

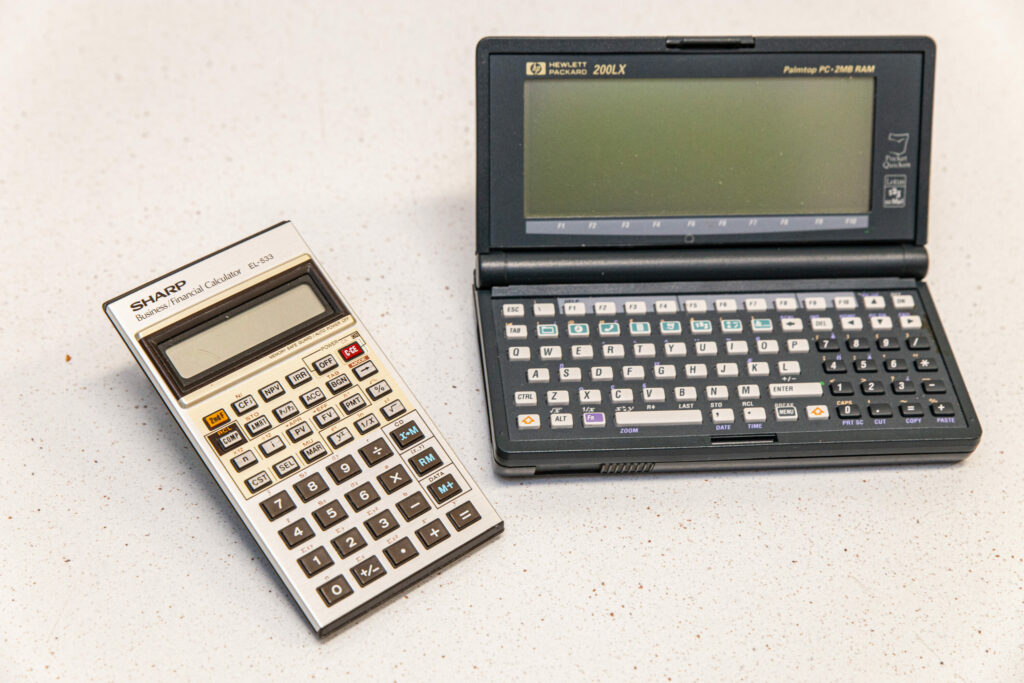

It was completely replaced by a whole range of financial and engineering calculators that multiplied a person’s productivity.

Since then, of course, we have probably moved on to simply asking Siri and even ChatGPT to obtain our answers to complex questions.

That’s progress and there is no prize for resisting.

As Brian Summers (fee.org) reminded me….

What is true for a slide-rule is true for any material object ― its usefulness, and hence its value, is in the eye of the beholder. In particular, an object is a tool ― a capital good ― only to someone who perceives it as a tool. The value an individual places on a capital good is determined by their estimate of its future usefulness.

This simple observation ― capital is in the eye of the beholder ―has profound consequences because it helps one choose between free enterprise, in which capital goods are controlled by individuals, and socialism, in which capital goods are controlled by the government.

In a free enterprise economy, businesspeople seek profits. Thus, an object is a useful capital good only to those who believe it can help them earn profits. This is true for large corporations as well as small businesses. The division manager of a large corporation has a single mandate: Earn profits. Their job depends on how well they fulfill this mandate from the corporation’s stockholders. Hence, they evaluate factors of production ― land, labour, and capital goods ― according to their future usefulness in earning profits.

But what is the nature of profits? Are they something plundered from consumers? Or are they the rewards from efficient production?

A businessperson’s profits or losses are the difference between their costs of production and the selling price.

When a businessperson is planning a project, they hope to keep production costs at a minimum by making production efficient. This involves much foresight and planning. By the time the product is finished, the production costs are already paid or contracted to be paid. They are “water under the bridge”.

When the businessperson tries to sell the product, they hope that the price will be high ― at least as high as his costs of production . But there isn’t much the businessperson can do about the price except try to live with it. They would like to sell for more, but would lose customers to competitors, leaving some products unsold. There is little to be done at this stage except advertise and hope that consumers will buy.

In the final analysis, it is foresight and planning that earn profits.

What about socialism?

Under socialism, capital is still in the eye of the beholder. The manager of a nationalized enterprise still evaluates a capital good according to its future usefulness to him. But usefulness for what? In free enterprise a capital good is useful because it helps earn profits by making production more efficient. However, a nationalized industry is a monopoly. There is little incentive to cut costs of production because the nationalized industry can pay its bills simply by raising its prices (there are no competitors to whom consumers can turn) or obtain a subsidy from the government. Witness Australia Post.

Under socialism there is no competitive bidding for factors of production so prices must be set arbitrarily by the government.

How then does the manager of a nationalized enterprise evaluate the usefulness of a capital good? He evaluates it according to its usefulness in carrying out production orders issued by superiors. For instance, in Russia when the manager of a nail factory was ordered to produce a certain number of nails, he made small nails. When he was told to produce nails by the tonne, he made large nails. At no time did he consider consumers’ preferences for large or small nails because his job was to fill production quotas.

To summarise, in free enterprise capital is used by business to earn profits by efficiently producing goods and services. If a businessperson is not efficient, the selling price of the product probably will not cover its cost of production. In contrast, in a nationalised industry capital is used by production managers to carry out orders from their bureaucratic superiors. Whether or not this makes for efficient production is largely incidental because the difference can always be made up by government subsidies or with a higher monopoly price. Finally, under complete socialism it becomes impossible to measure efficiency because, with the market in chains, the government must arbitrarily decide what to produced, how much to produce (i.e., electric cars), as well as guess the costs of production. Instead of responding to the ever-changing evaluations of consumers, production is set according to the eye of the official in power.

Free enterprise, which depends on continued support from consumers is still the best system we have, and is worth defending, against the constant browbeating of the ‘woke-brigade’ and their distractions away from running a profitable business.

Regards,

Ron

We invite your responses, feedback and suggestions. If this resonates with you, please SHARE!